Profit on Disposal of Property in Malaysia Subject to Real Property Gains Tax (RPGT) or Income Tax?

Many a time we have investors asking us such a question. This article hopes to shed some light on the taxability of profit on disposal of property.

In the case of isolated transactions, these can either fall under:-

(a) Business gains which means it arise either from trade or ‘adventure or concern in the nature of trade’. These will be subject to income tax under Business Income Section 4(a) of Malaysian Income Tax Act 1967.

(b) Capital gains which means it arise from realization of investments. Being capital in nature, these are not subject income tax and is subject to RPGT instead for disposal of property.

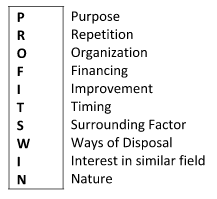

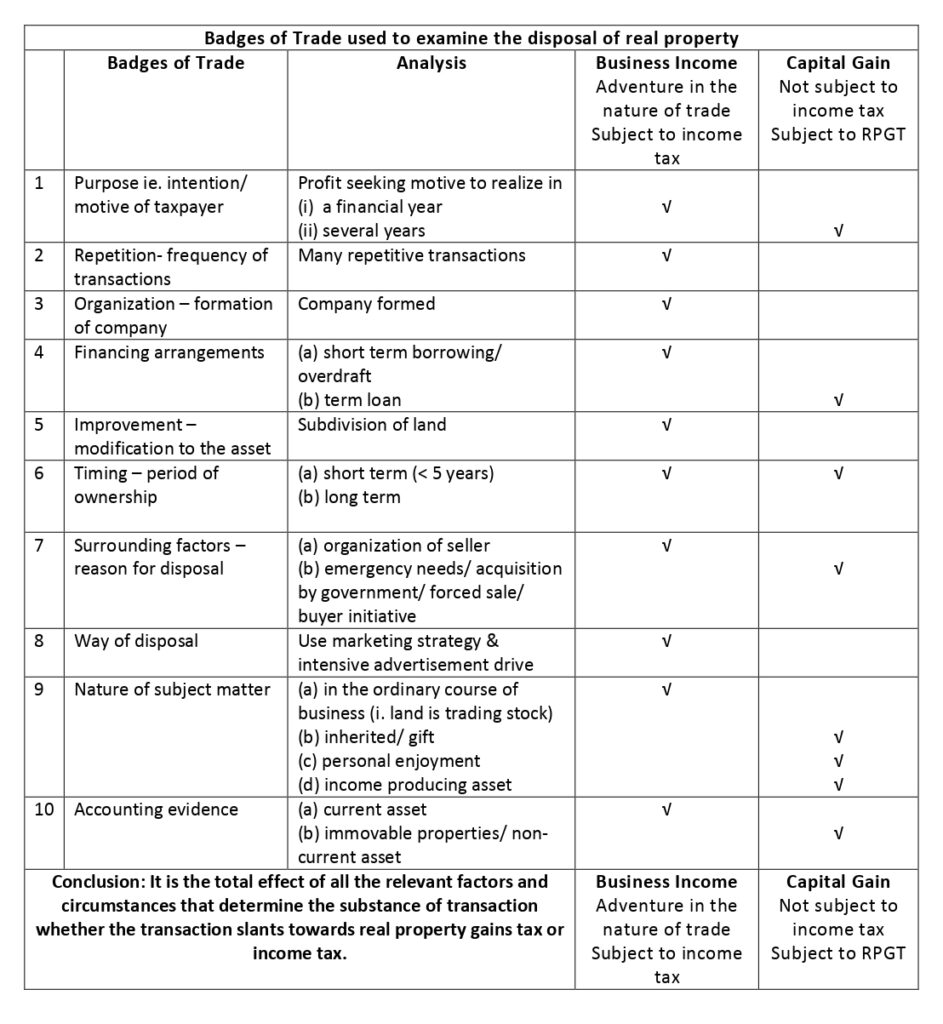

Badges of Trade

It is important to note that it is the total effect of all the relevant factors and circumstances that determine the substance of transaction whether the transaction slants towards real property gains tax or income tax.

(1) P : Purpose ie. Intention/ Motive of taxpayer

The true intention of the tax payer (presence of profit seeking motive) at the point of acquisition determines whether the subsequent disposal points towards trading or it is a mere realization in investment. Permanent investment sold to acquire another investment would not involve an intention to trade, whether the first investment is sold at a profit or loss. In order to ascertain objective and intention of a limited liability company, it is permissible to look into the objectives of the company as detailed in Memorandum of Association and Board Resolution.

(2) R : Repetition ie. frequency of transactions

A repetition of transactions carried out in systematic manner may constitute trading. The more transactions a person carries on in a similar line, the stronger the probability that he is carrying on a trade, as the whole essence of trade is to carry on a continuous stream of transactions in similar commodities. One purchase of large quantity for many subsequent sale transactions can be for the purpose of trading or adventure in the nature of trade.

(3) O: Organization ie. formation of company

Companies are set up with the prima facie assumption for profit making for its shareholders. As such, a company may hold a property for long period, any subsequent disposal may be viewed as business income as holding period was to wait for the right opportunity to realize profits.

(4) F : Financing

The mode and period of financing are important in determining whether the taxpayer is venturing into trade. If the company had the intention to hold the property as long term investment, more funds is injected into the company eg. via issues of shares. For individual, utilization of savings or profits earned indicate intention to hold investment for long term. In contrast, if external short term financing is sought eg. overdraft or term loan- whereby interest expense is more than income generated, this would indicate intention to dispose investment within the short period of time.

(5) I : Improvement ie. alteration to increase marketability

Material alterations or improvements have been made to a property acquired for the purpose of making it more saleable, the disposal of such property would tend to indicate a trading transaction. For land, when tax payer subdivides, converts land from agriculture to commercial, industrial or residential use- such move would be viewed as a step towards ‘adventure in the nature of trade’. If the property was clearly acquired for the other purposes, extensive activities to render it more saleable after it is no longer useful for the original purpose will more likely not cause the profit to be taxable. Hence, the intention at point of acquisition is to be examined.

(6) T : Timing ie. holding period

The longer the period of ownership of the subject matter before its disposal, the less likely such disposal would be considered as part of trade. The term ‘short period’ and ‘long period’ is not defined in the Malaysian Income Tax Act 1967 or case laws. An indicative duration of ‘long period’ is more than 5 years. A quick resale supports a finding of trading where other elements of trading are present.

(7) S : Surrounding factors ie. circumstances leading to realization

A sale must be consensual and at one’s free will before gains can be chargeable to tax. Forced sale would not constitute trade. Exception to this is the trading stocks- though sold under forced circumstances, the proceeds will still be considered as normal gross income and be subject to income tax.

If sale of property is a result of sudden emergency or unanticipated need for funds, such facts will indicate that the property was not acquired for purpose of resale at profit and that the sale is not pursuant to profit making scheme. If taxpayer acquired the property pursuant to a profit making scheme and was presented with the opportunity to sell, these factors when considered together with the other factors may indicate intention to trade.

(8) W : Ways of disposal ie. methods employed in disposing

Special efforts or organized activity to promote sale ie. exertion by disposer to attract purchaser eg. opening up office or advertising extensively point towards profit making intention. This can be compared against efforts initiated by buyer or ad hoc advertisement carried out.

(9) I : Interest in similar field

If a person is already trading in a particular subject matter, further transaction having connection with the same or similar subject matter would tend to point towards trading. Too much emphasis should not be placed on this as it has been found in case laws that a trader can hold an asset similar to his stock in trade as his private investment rather than for trading purposes.

(10) N : Nature ie. subject matter

Where the property does not itself yield income or provide personal enjoyment to its owner merely by the virtue of its ownership and which is normally the subject of trading and rarely the subject of investment, is more likely to be acquired for the purpose of resale at a profit and hence, subject to income tax.

Among examples of items which may be acquired for reasons other than selling at a profit but rather for personal use or enjoyment eg. jewellery, watches or paintings and for investments to produce income eg. shares. Certain items may be acquired either for personal use or as trading stocks, but if they were acquired in a large quantities (eg. toilet rolls purchased in millions), it may be quite clear that the item can only be used for the purpose of trading. Any gains arising from the sale of it should then be taxable under S4 (a) of Income Tax Act 1967.

Where the subject matter has been treated as trading stock, then the sale of it would be subjected to income tax even though it was sale in hard pressed situation. Where the subject matter is property for investment and the owner chooses to realize it, the enhanced price may not be profit assessable to income tax, but rather Real Property Gains Tax.

Item acquired by way of purchase, the circumstances in which it is bought or the correspondence leading up to the purchase may show that it is bought either for resale (ie. trading) or for private purpose or as an investment. However, an item which is inherited or received by way of gift, it would indicate that the item was not acquired with a view to sell for profit.

We hope this article shed some light on whether profit on disposal of property is subject to Real Malaysian Property Gains Tax (RPGT) or Income Tax Act 1967.

Credit : Reference is made to Malaysian Taxation written by Alan Yeo and Malaysian Taxation – Principles and Practice by Choong Kwai Fatt.

Disclaimer : We do not take any responsibility and shall not be liable for any misunderstanding, loss and damage caused by the information above. Kindly seek professional advice from your tax consultant for more detailed clarification..

We would be pleased to provide solutions to your tenancy requirements for factory and warehouse including sublet. Do contact Joyce at +6017 333 8007 or joyce@industrialspace2u.com to learn more about the industrial property we have that is up for sale or rent!