Article written by Joyce Low, founder of industrialspace2u.com on 3rd January 2022.

Our clients frequently enquired of the differences between buying a relatively cheaper agriculture land in industrial zoning versus buying an industrial land in a planned industrial park.

There is certainly a variance in the price point. This article seeks to address the cost components that a purchaser of industrial land should be aware of that justifies the higher price paid for industrial land in planned industrial park apart from the ready infrastructure available.

Conversion of land use

Conversion of land use refers to the variation of the category of land use stated in the land title. Alienated lands are divided into 3 categories of land use: ‘Agriculture’, ‘Building’, and ‘Industry’. Express conditions are those specially endorsed or expressed on the land title (e.g. the land may only be used for schools.

The land owners must use the land in accordance with the category of land use and the express condition stipulated in their land title. Failure to do so is a breach of condition of the land alienated and the State Authority can forfeit the land. As such any land owner who intends to use his land for another category of use other than the category stated in the title, must apply to change the category of land use accordingly. Sections 124 and 124A of the National Land Code and the respective State Land Rules allow landowners to apply for such changes.

The State Authority will charge an additional premium on all applications approved for change of use. Variation of land conditions is a process whereby a registered proprietor applies to change the usage of the land from one purpose to another for example from agriculture to industry, so that the land can be developed for factory or warehouse use.

It is worth noting the landowners are required to check with the Local Municipal’s updated Local Plan for the land usage zoning to determine whether the category of conversion requested is permissible.

Land use stated on title

1. Agriculture

2. Tiada (None) Hence, it shall be taken as Agriculture

Intended Use

Action Plan

1. Conversion via Section 124 or

Section 204 National Land Code 1965

2. Payment required for

a) Conversion Premium

b) Development Charge

c) Improvement Service Fund

before development order is approved

Conversion Premium Payable

Conversion Premium based on Selangor Land Rules 2003

Conversion Premium Payable

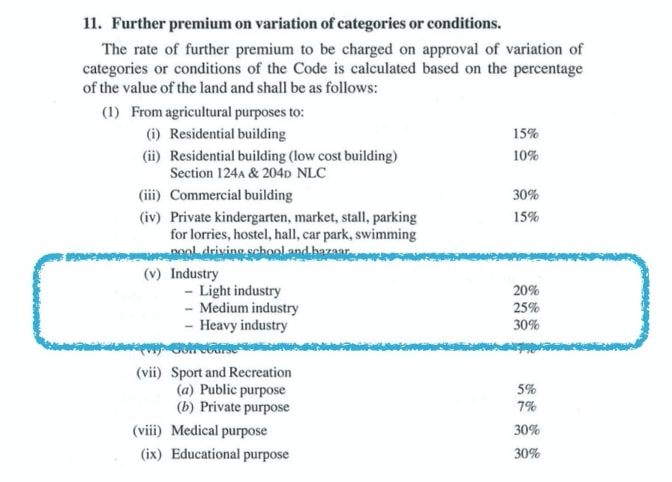

Each state has its own formula to calculate the premium payable for alteration or change of land use. The land conversion premium is usually calculated based on the enhanced value of the land after conversion. The premium rate ranges from 15% to 30% depending on whether the converted land use is for residential, industrial or commercial purposes.

In Selangor, the Selangor Land Rules 2003 states that to change the category of land use from agriculture to residential use, the additional premium payable to the state authority is 15% of the land value. To convert the land to commercial use, the additional premium payable is 30% of the land value. As for industrial developments, the rates are 20%, 25% and 30% for light, medium and heavy industries, respectively.

Valuation for conversion of land use, or more technically, change of category of land use or express condition of title, is normally carried out by the Valuation and Property Services Department or Jabatan Penilaian dan Pengurusan Harta (JPPH). JPPH will carry out the valuation upon request and advise the Land Administrator. A valuation of the land is required because the law requires an additional premium to be paid when an application for a change in category of land use/ express condition is approved. The calculation of the additional premium is based on the State Land Rules.

The basis and rates of premium differ between the respective states in Malaysia. In almost all instances, a market value has to be determined. Theoretically, the additional premium charged is a percentage of the difference in value between the new and the existing use. Where valuation is required, the valuation would be the market value for the new use and the market value for the existing use. The percentage rate and the basis for the computation of additional premiums are provided for in the respective State Land Rules.

Among the factors that are taken into consideration in the valuation are condition of the land as at the date of valuation, the type of development that can be approved, location, shape and size of the subject land. JPPH will report the valuation to the Land Office/Land and Mines Office. The landowner must submit his conversion of land use application to the Land Office/ Land and Mines Office

Development Charge

Upon development order approval, the subject properties will be subjected to the payment of development charges as well as other related ancillary fees which will be determined by relevant Approving Authorities.

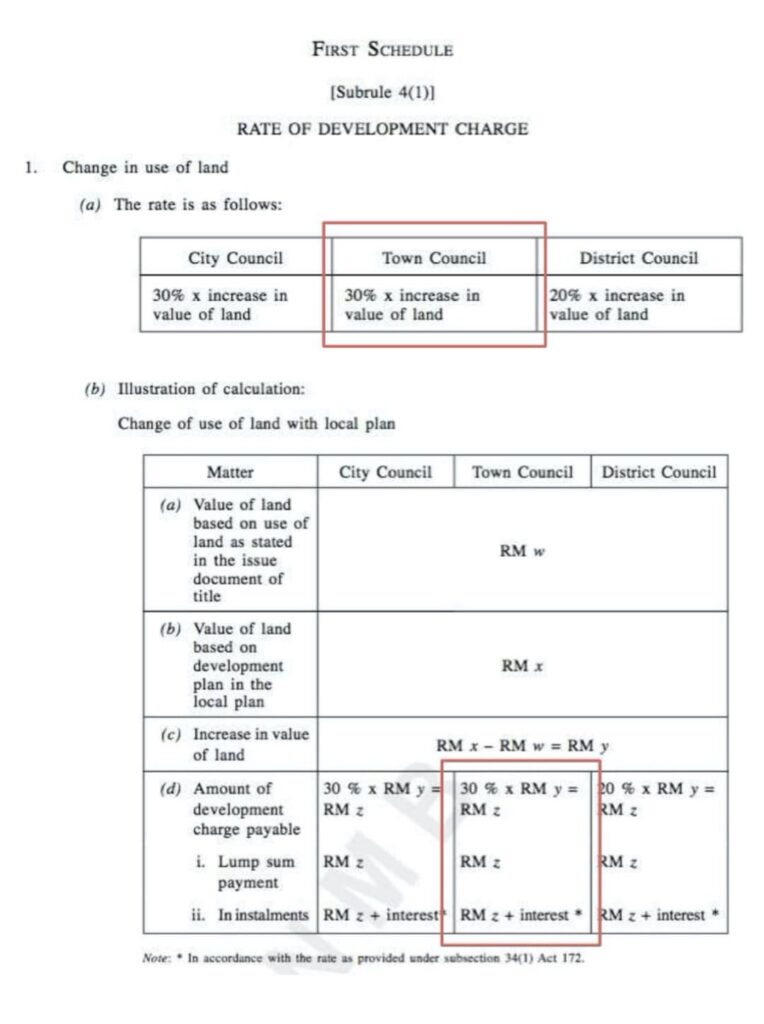

The Development Charge is levied on enhanced land value of a development proposal due to change of land use and/or an increase in population density and/or an increase in plot ratio. It is calculated based on 30% of the enhanced value of the land, before and after development.

In addition, the Development Charge is also imposed for a shortage in provision of car parking bays.

The following is extracted from Akta Perancangan Bandar dan Desa 1976 under Kaedah- Kaedah Caj Pemajuan 2010 by Selangor State Government.

Improvement Service Fund (ISF)

The ISF is a fund established in each local authority to collect funds for the purpose of the beautification, construction or laying out of any street, drain, culvert, gutter or water-course in their jurisdictions, according to the Street Drainage and Building Act 1974.

Timeline for the Conversion Process

The total duration of land conversion application varies from 6 to 9 months. The landowner can appoint a professional consultant to provide guidance in the procedure of conversion application and to expedite the conversion process.

Many a time purchasers of agriculture land in industrial zoning may have overlooked the time cost in the conversion process as well as the development charge to be levied upon development order approval by the local council.

Hence, purchase of industrial land in a planned industrial park would remove all this ‘hidden cost’ which would surface upon Development Order (or Kebenaran Merancang) being submitted after the Sale & Purchase Agreement has been inked and transaction has been completed.

We hope this article enlightens the purchaser as well vendor of agriculture land in industrial zoning of the price point differences to be aware of.